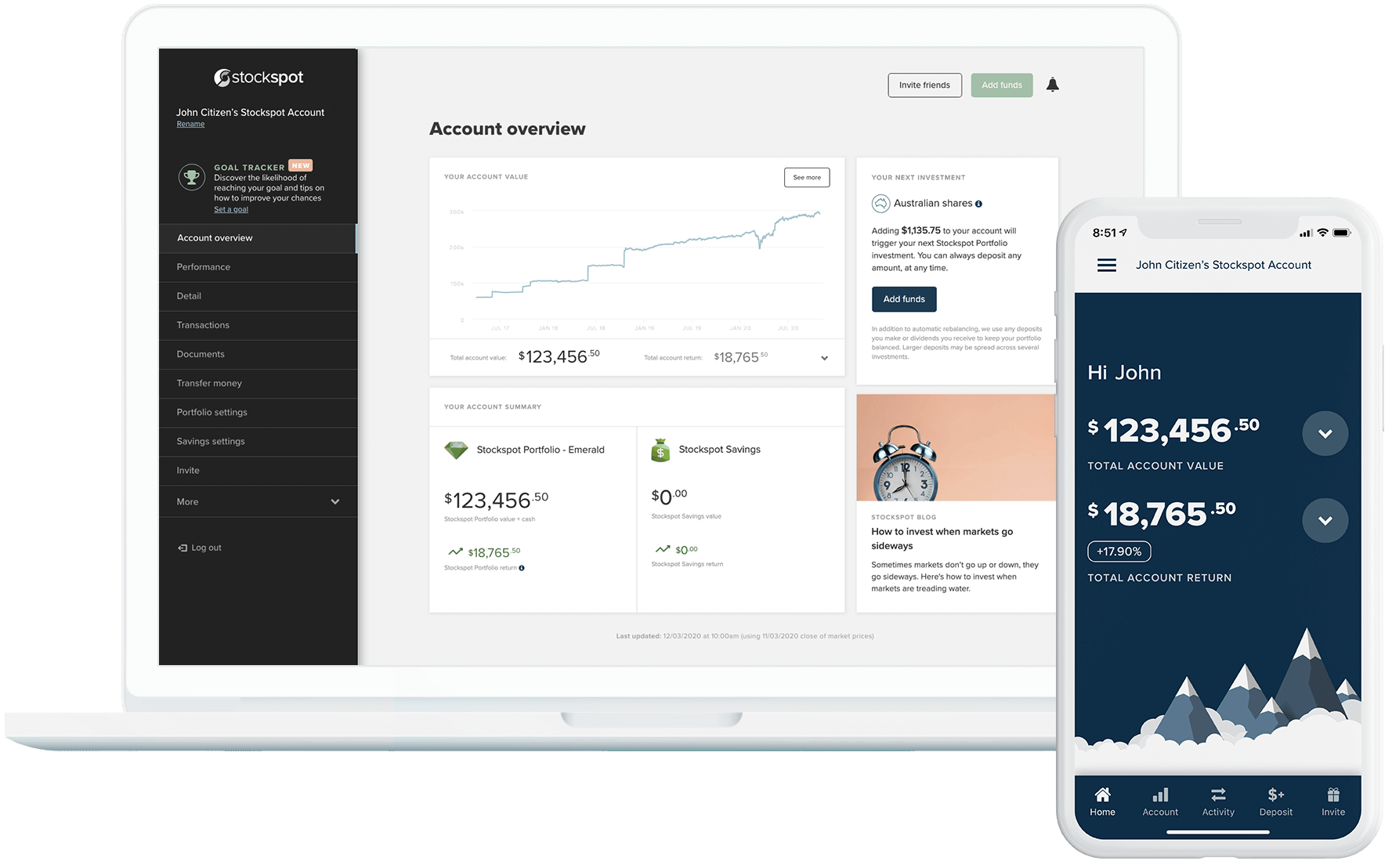

Invest with confidence

Let us build you a diversified portfolio of global investments with a strong track record. Take control of what’s important to you, and save time on tax with everything done for you.

Take control

Personalise your portfolio with a range of themes including dividend shares and, socially responsible shares.

Stockspot themes »Trusted experts

We publish Australia's most widely read ETF research and superannuation research every year.