Comparing Six Park to Stockspot

* Information on Six Park is based on details from their website, blog and Financial Services Guide (FSG) as at 30 July 2023.

Frequently asked questions

How is Stockspot’s investment strategy similar or different to Six Park?

Six Park and Stockspot have similar investments in Australian shares and Australian bonds. For Australian shares Six Park recommends an ETF which tracks the S&P ASX/200 whereas Stockspot recommends a larger and lower-cost ETF that tracks the broader S&P ASX/300.

We both recommend the same iShares Composite Bond ETF (IAF).

Stockspot and Six Park both offer Sustainable investing options.

Six Park holds hedged global ETFs, property and infrastructure and does not own any gold.

Stockspot holds gold as a defensive asset and does not hold hedged global ETFs as we believe they create too much bias towards the Australian dollar. Stockspot doesn’t hold property or infrastructure as standalone investments as there is already sufficient exposure to these assets within Australian and global shares. These differences have contributed to Stockspot outperforming Six Park over five years in all investment categories from conservative to high growth.

How do I transfer my portfolio from Six Park to Stockspot?

Can I move my Six Park ETFs to Stockspot via a HIN transfer?

- Firstly we recommend speaking with our advice team to discuss the best options for you (sell down or partial HIN transfer)

- Speak to an accountant or tax advisor to understand any tax implications

- Set-up your account online, step through and get your portfolio recommendation

- Deposit funds into your Stockspot account for investment. Or if you are HIN transferring some assets in (after speaking with our advice team), you will need to complete a HIN transfer form and add additional funds to build out your portfolio)

What is the process for setting up an account with Stockspot?

You can click the “Get Started” button and follow the prompted steps to set up an account with Stockspot.

Stockspot's investments (ETFs) differ from those of Six Park. As a result, we are unable to offer a full HIN (Holder Identification Number) transfer of existing Six Park holdings to Stockspot.

Stockspot is not licensed to provide advice on your existing Six Park portfolio, including any tax implications. We encourage you to carefully evaluate your options and, if necessary, seek separate advice from a financial professional before making any decisions to sell your current investments and move to Stockspot.

Get your free personalised portfolio recommendation

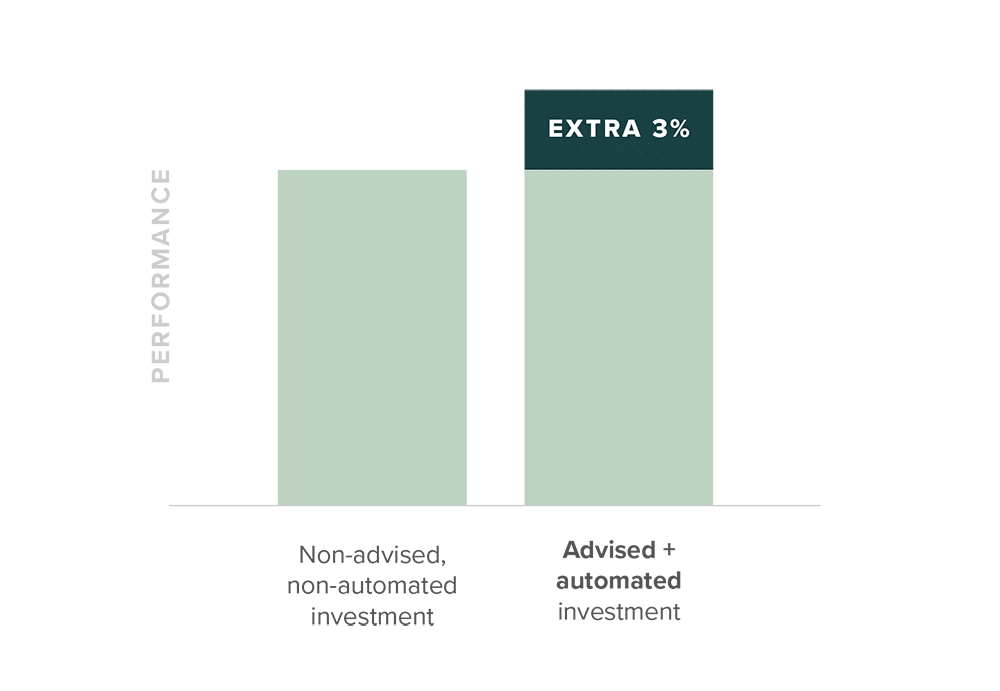

Advice + automated investing = better returns

The right advice can increase performance by around 3% per year. This extra return comes from:

- An investment strategy designed to suit your goals, risk profile, and time frame. Studies show your mix of investments drives 90% of returns.

- Optimised rebalancing. This can add up to 1% in additional returns per year.

- Behavioural coaching. Education around investing removes costly behavioural biases.

Meet the team

Founder Chris Brycki started Stockspot to help Australians invest better and achieve financial freedom. As a professional fund manager he saw too many people getting ripped off by bad investment advice and high fees. Chris left his career to build Australia's first personalised online investing platform.

Today, Stockspot has a team of qualified professionals who help guide thousands of clients to build wealth with a proven investment strategy.

Our set of principles guides how we advise clients and invest their money. This is our DNA and what sets us apart from other products and investment managers.

Stockspot team Our principles

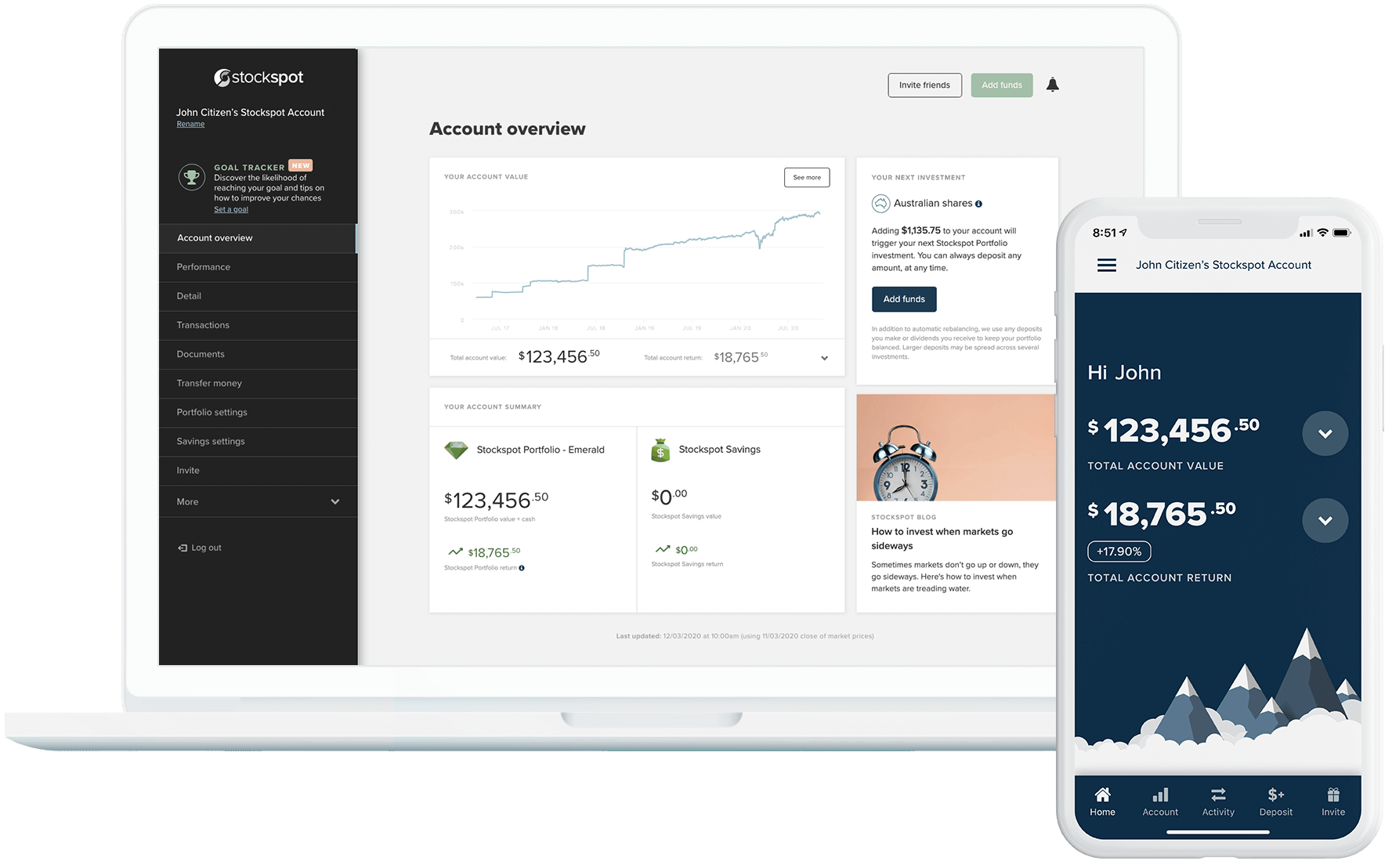

A personalised dashboard to view your portfolio

Add to your investments to grow your wealth faster.

Monitor your portfolio to see the performance of your investments.

Keep track of your investment goals.

View your personal dashboard on any device.

Trusted by thousands of Australians

We're trusted by thousands of clients to manage hundreds of millions of dollars. That's because we always act in our clients' best interests.