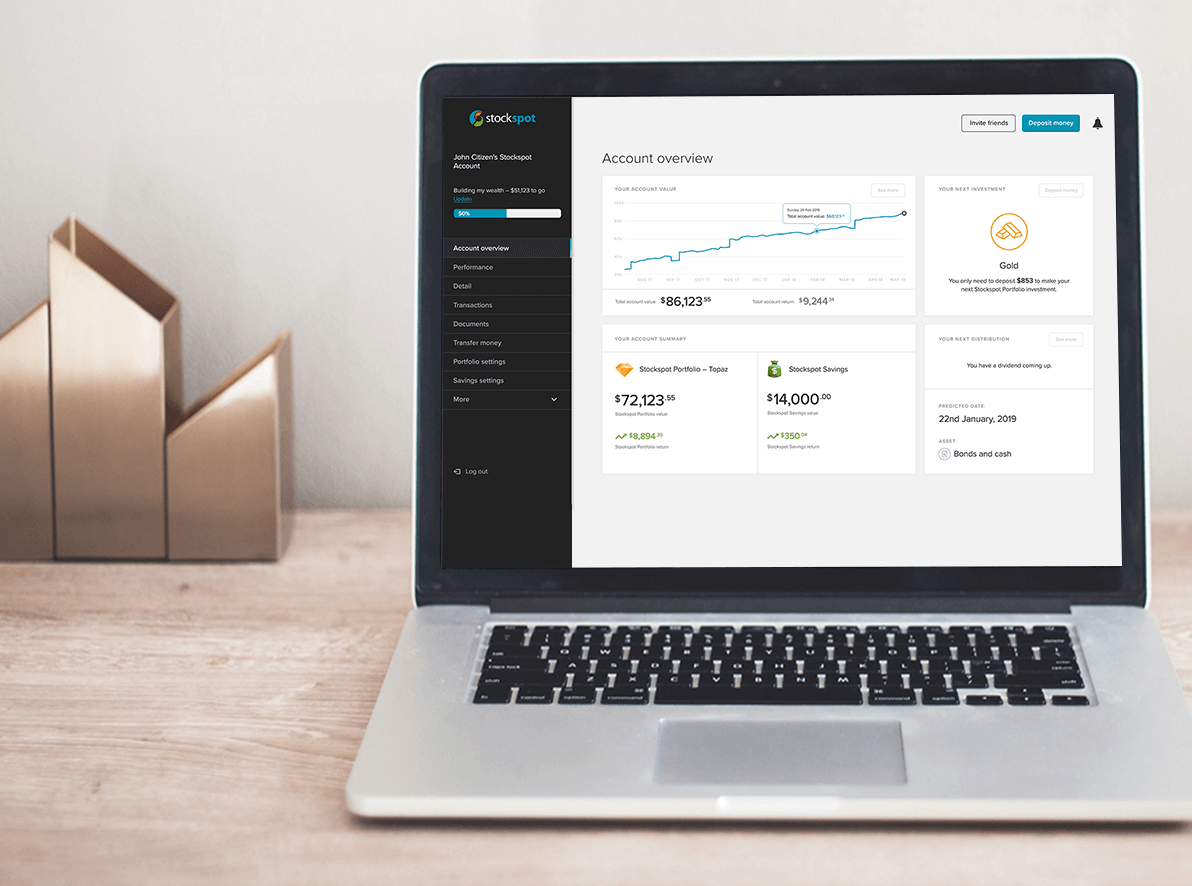

SMSF investing made easy

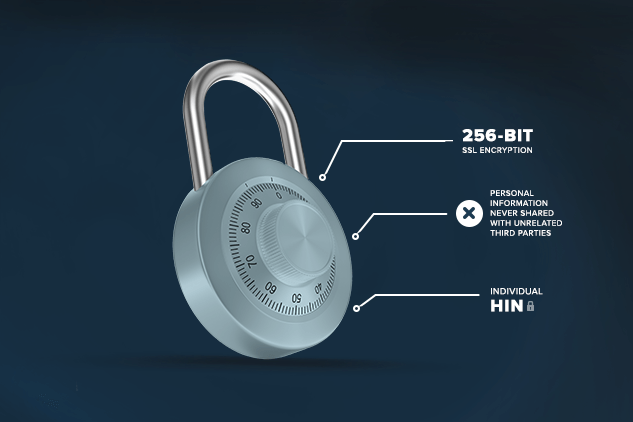

SMSF investors can take the hassle out of growing and protecting their retirement savings. Stockspot helps you invest in a portfolio of low-cost ETFs (exchange traded funds) by combining the efforts of experienced investment advisers and an automated investment platform, supporting you in the accumulation and retirement phases of your investment journey.

Learn more