Investment options in Australia

Where should you invest? Let's look at some of the best investment ideas to grow your wealth by investing in the share market.

Smart investing is about growing your wealth steadily and minimising the risk of losing your hard-earned money.

Here are some ways of investing in the share market.

Direct shares

Investing in shares means you're part owner of a company. Shares grow your wealth through an increase in the share price, income paid as dividends, or a mix of both.

Picking individual shares can be risky because it's hard to pick the right shares to invest in. Investing only in shares means your investments aren't diversified.

Managed funds

A managed fund pools money from a range of investors, and a fund manager allocates this money to different assets like shares, bonds, or property.

Managed funds can employ passive or active investment strategies.

However, research shows that many active managed funds fail to beat the market.

Listed Investment Companies (LICs)

This is a company structure that is traded on the ASX, but only has a fixed number of share units available.

Like a managed fund, LICs pool money from investors to buy a range of investments.

LICs won't always trade at their true value (known as a discount or premium), and tend to underperform the market.

Exchange Traded Funds (ETFs)

ETFs are a low-cost type of investment listed on the stock exchange. They provide direct access to a wide range of investments such as Australian shares, international shares, bonds or metals.

You don't need to pick shares or time the market, because ETFs provide the return of an entire asset class or index.

The best way is to ensure you have a diversified portfolio that's rebalanced periodically.

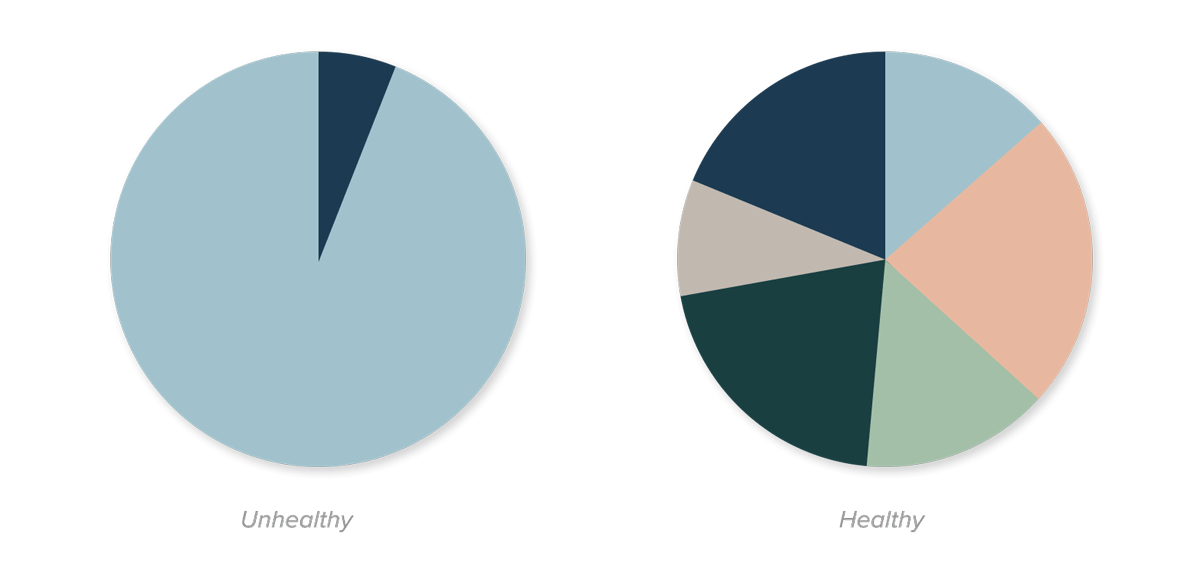

Diversification means combining different investment options like shares, bonds, and property so that all your eggs aren't in one basket. When one investment falls, others are likely to rise. This means the impact of one asset crashing won't hurt so much.

A portfolio of 10 or 20 Australian shares doesn't lead to proper diversification because people often buy companies that sit within common sectors. This means they're all exposed to the same factors in the Australian economy, and will move in the same direction as each other.

ETFs (exchange traded funds) are an easy way to invest and achieve diversification. You don't pick individual stocks because each ETF tracks an entire asset class like Australian shares (ASX 200) or global shares (S&P 500). ETFs give investors exposure to lots of different markets and assets across the world.

Get my free portfolio recommendation

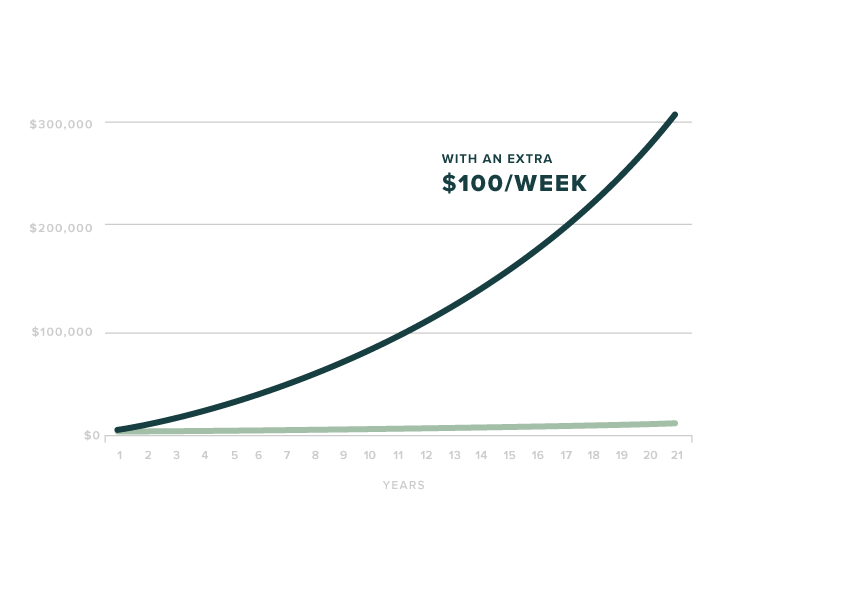

Assuming an initial amount of $2,000 at 9% return per year

Before investing money you should pay off debts like credit cards and personal loans. The interest paid on these is higher than the returns you'll make on investing. Ideally, you should also have 6 months worth of living expenses in an emergency fund.

If you want to use a traditional financial advisor, you might need a minimum investment of at least $200,000 before they will talk to you. However, if you want to invest with Stockspot, our minimum investment is $2,000.

You might not have a large amount to invest with initially, but regular contributions to your investment portfolio will help you experience the magic of compound interest.

Get my free portfolio recommendationStockspot doesn’t invest in property directly, but if you’re investing more than $50,000, you can tailor your portfolio and focus the ETFs in your portfolio towards property.

We think you should be looking to invest for at least a few years. Any shorter and you’re speculating, not investing. The longer you stay invested the better your chance of success.

We custom-built our questionnaire so that we can find out all the details we need to know about your situation.

Our smart algorithms are then able to recommend a portfolio that’s best suited to your preferences and goals.

Yes, you can withdraw your money at any time with no penalty fees.