Investing made easy for trusts

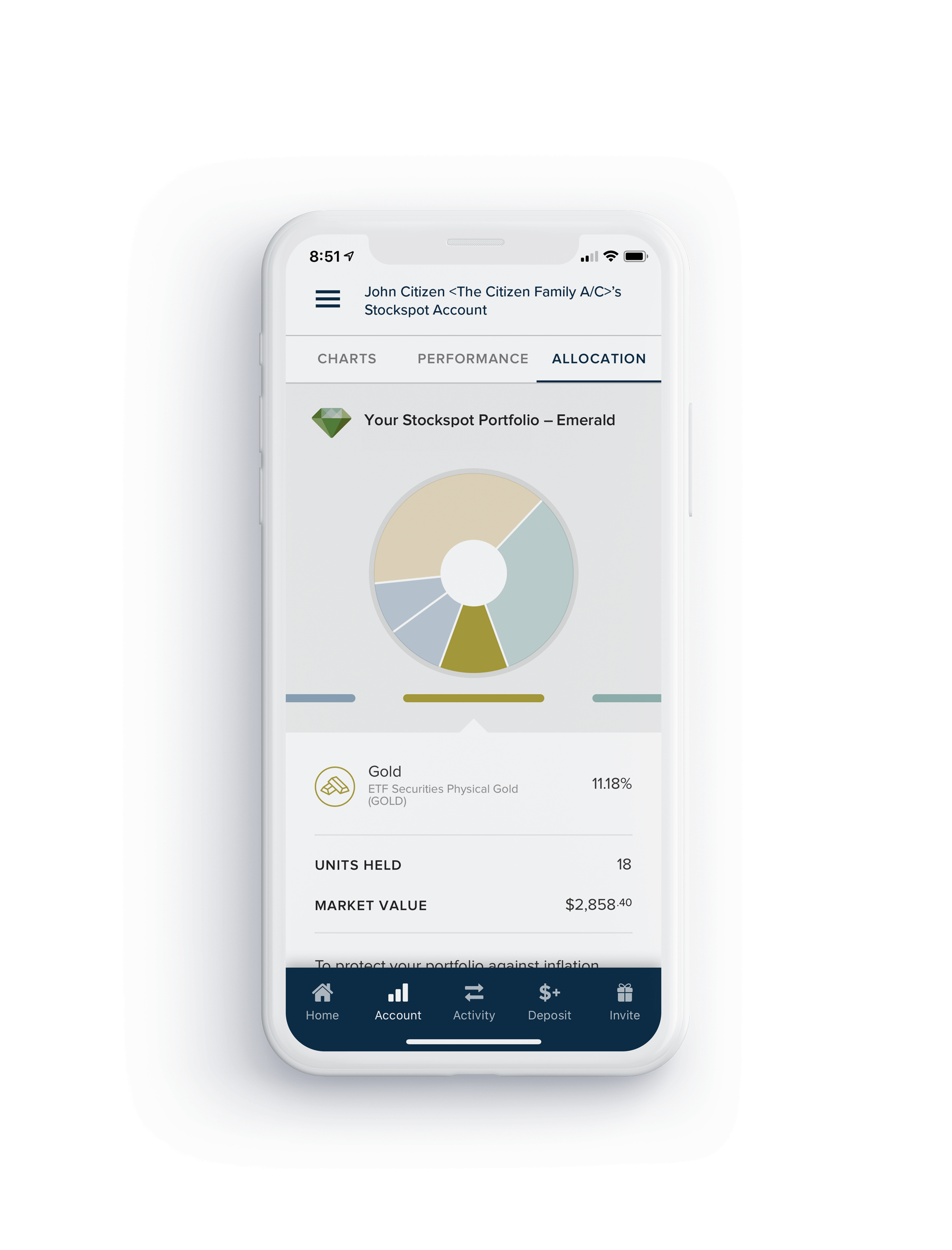

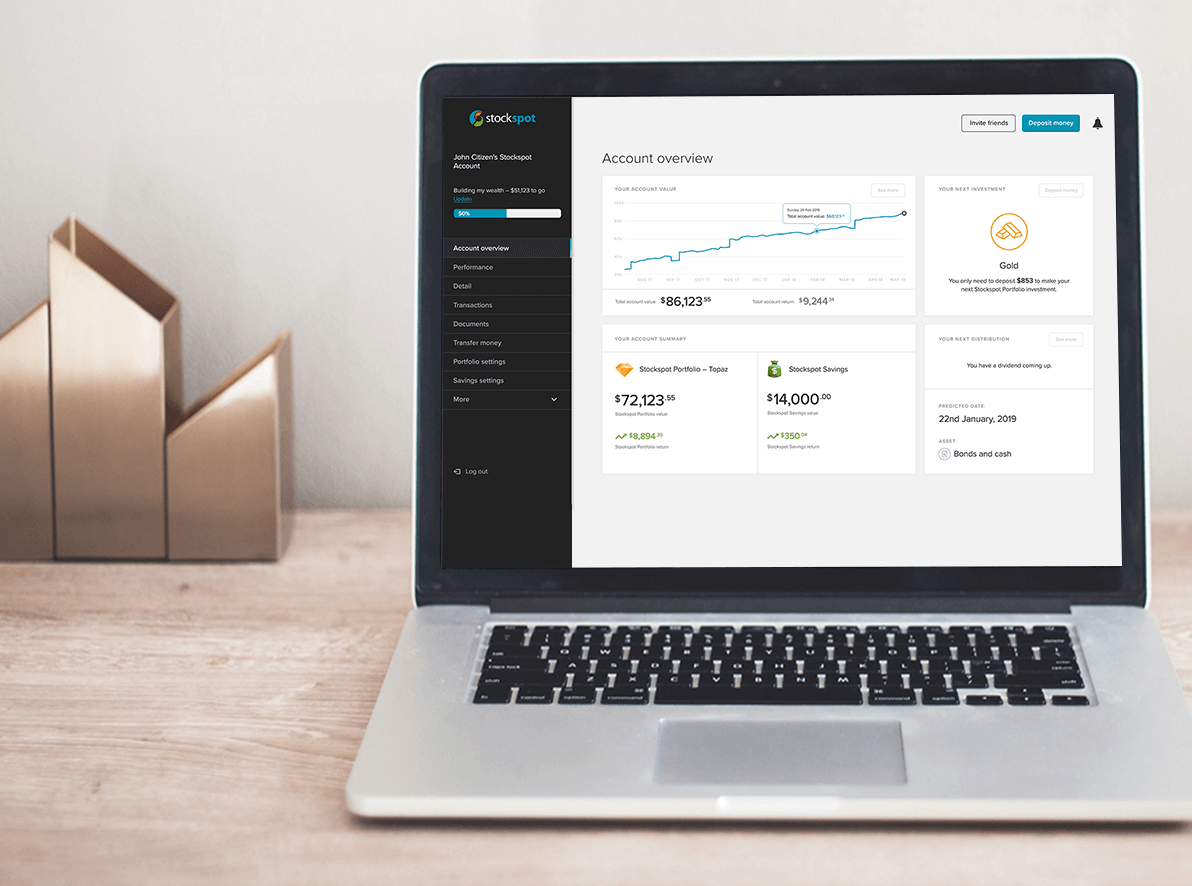

Investing as the trustee of a family, discretionary, or testamentary trust? Take the hassle out of growing and protecting your money. Stockspot helps you invest in a portfolio of low-cost ETFs (exchange traded funds) by combining the efforts of experienced investment advisers and an automated investment platform.

To have a Stockspot financial adviser contact you directly via email or phone call.

Get startedGet started by opening a Stockspot account right away — it only takes a few minutes.

Alternatively, contact us to discuss any questions