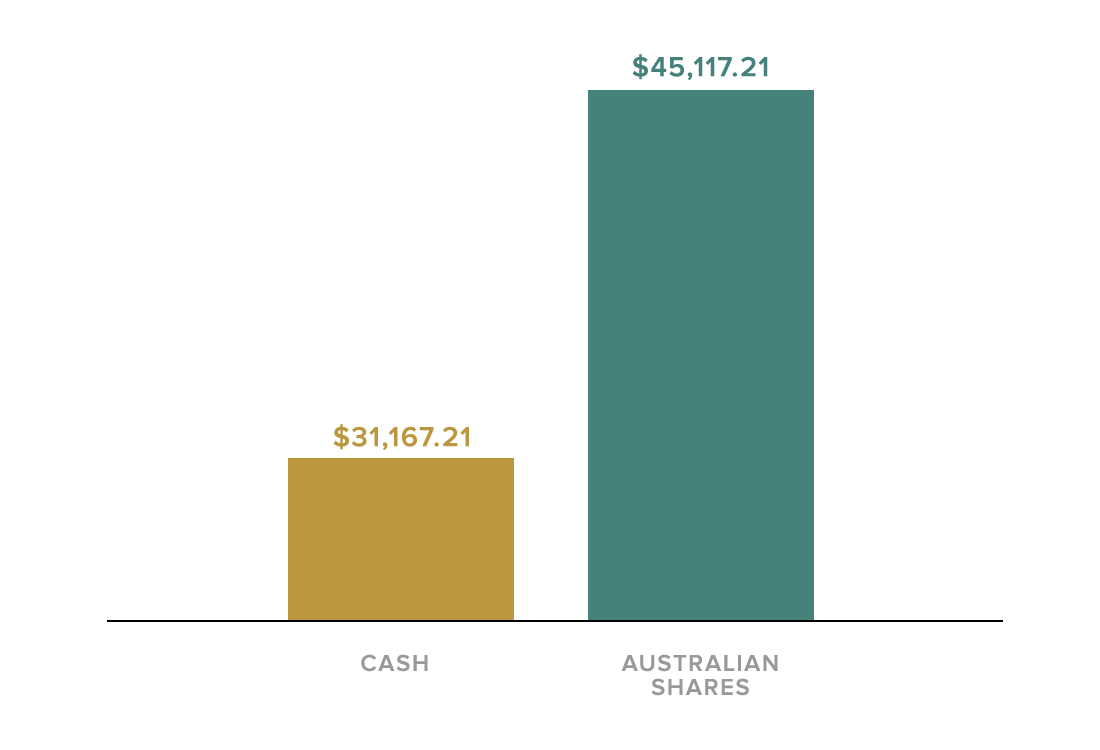

See the difference:

Putting $25,000 in a savings account 7 years ago would be worth about $31,167 today, compared to over $45,000 in shares.

Use our Compound Calculator to see the growth of a diversified share portfolio earning returns of between 5% p.a. and 9% p.a.

Source: Vanguard. Overall returns for asset classes for a 7 year period from 01/07/2010 to 30/06/2017. Returns taken as constant for all years and amounts are not adjusted for inflation.

Investing is easy with us

Investing with Stockspot is easy. Tell us a bit about your investment timeframe and goals. We develop a personal investment strategy to help you get there. You can top up or withdraw at any time without paying any additional fees.

Your portfolio is personalised for you and updated as your circumstances change.

You can see the investments in your portfolio online anywhere, anytime.

There are no exit fees or withdrawal fees. It's your money, you can always access it – no strings attached.

There's no paperwork, nothing to post, and no jargon. We keep things simple because that's how investing should be.

Benefits of Stockspot portfolios

Investment expertise

We continually research and review the best investments for your portfolio

Keeps risk under control

We precisely rebalance your portfolio as the market changes

View your portfolio anytime

You can keep track of your portfolio and investing goals online and on our app

Enjoy fewer ups and downs

Diversification into bonds makes our portfolios less risky than just owning Australian shares

Makes your money work harder

We automatically reinvest your dividends, earning you more

Local team available to help

We help thousands of people every day, from those just starting out to experienced investors