Strategic investing for charities and NFPs

Plan for tomorrow with our safe, proven investment strategies, tailored to the unique needs of charities and NFPs (not-for-profits) to help achieve their missions.

Schedule a callCharities and NFPs use online investment advisors for their:

Custom-built, diversified portfolios that have had consistently strong performance. Our evidence-based investment strategy avoids risky stock picking and market timing.

We're trusted by thousands of clients to manage hundreds of millions of dollars. We always act in our clients' best interests.

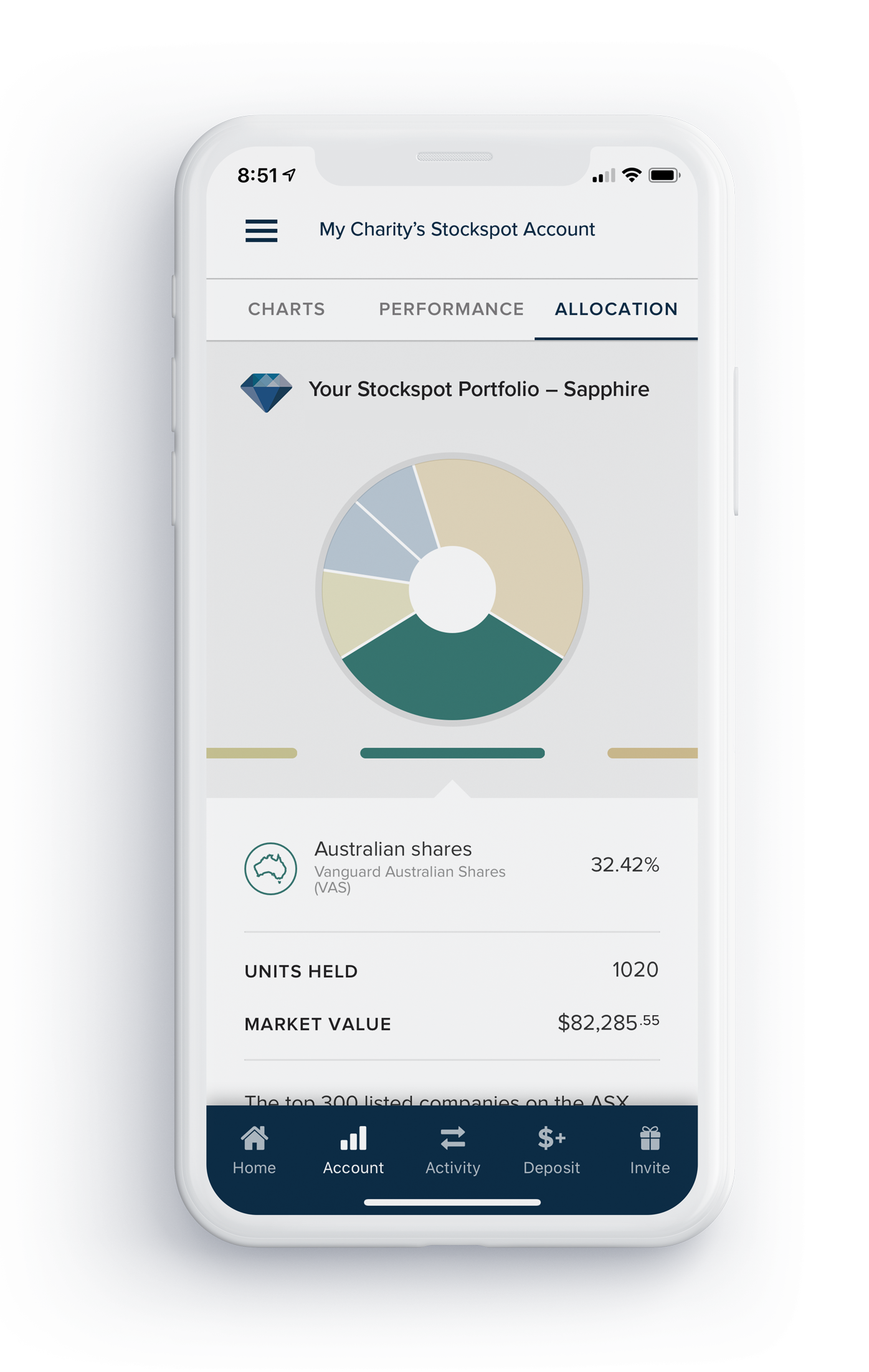

Our online platform enables you to securely monitor your investments 24/7. Our risk management frameworks are designed to meet the highest governance and compliance standards.

Using Stockspot as your investment partner means you’re planning for the future in a cost-effective, strategic way. Our experienced team will work with you to build a portfolio that aligns with the goals of your organisation.

You’ll have access to innovative cost-saving rebalancing technology, and our team of dedicated experts will always be on hand to assist with any questions.

Your portfolio is accessible 24/7, and we provide you with in-depth performance updates in line with your reporting requirements.

Schedule a call with us today and receive a free portfolio review or portfolio recommendation.

Chris Brycki, Stockspot’s Founder & CEO highlights the common investment mistakes made by charities and NFPs.

Chris has been a member of the ASIC Digital Advisory Committee and sits on the Investment Committee for the NSW Cancer Council. In this video, he explains why charities and NFPs often underperform the market, and how your organisation can stay ahead.

Video length: 6 mins

Every organisation is different. We make sure your portfolio aligns with your mission, your cash flow objectives, and your investment policies.

Our portfolios have delivered far more consistent returns than only investing in Australian shares.

Unlike some asset consultants, stock brokers, and investment platforms, we don't receive commissions from any of the ETFs we recommend.

Our globally diversified portfolio of the best low-cost index ETFs (including bonds, gold, and global shares) are structured to minimise risk. Sustainable options are also available, as well as various themes like U.S. shares and technology.

Our investment advisers are on hand to assist you and your stakeholders with regular insights and detailed performance reporting.

As your wealth grows with us, so do your benefits. Enjoy lower fees and exclusive perks with our Platinum and Diamond fee tiers.

View our pricingPlatinum

$200,000+ IN ASSETS

Get priority access to an adviser and enjoy a low fee of 0.528% per year across all your investment accounts.

Learn moreDiamond

$2M+ IN ASSETS

Experience our highest level of service with an ultra-low fee of 0.396% per year across all your investment accounts.

Learn moreYes, you will receive distributions on a quarterly basis, with any franking credits passed onto you through these payments.

After our initial conversation with you, we’ll guide you through our online application process.

Once you’ve answered some key questions, you will be recommended a strategy based on your risk tolerance and your investment time frame.

Our dedicated advisors will ensure your recommended strategy is aligned with your organisation’s investment goals.

We can give view-only access to the Stockspot dashboard to any nominated stakeholders such as board members and the investment committees.

This means they are unable to transact or change strategy but can view the performance and breakdown of the portfolio.

No. With a Stockspot account, you have total flexibility.

There are no lock in contracts and you can withdraw your funds whenever you wish. When you withdraw the funds are paid into your nominated bank account within five business days.

Stay up to date with our weekly articles covering investing, news and insights.