Find out the best performing super funds

Thanks! The 2022 Fat Cat Funds Report will be emailed to you in the next few minutes.

Pick the best super fund for you

Superannuation is your hard-earned retirement savings, affecting the quality of life you'll have once you've stopped working. That's why getting your money into the best super fund is one of the biggest financial decisions you'll ever make.

Unfortunately, many funds make comparing superannuation difficult. They make it hard to know how much you pay in fees AND they often hide their investment strategy.

It only takes two minutes to check the health of your superannuation fund, and by comparing your super, you could save more than $245,000.

The Stockspot Fat Cat Funds Report does all the work for you by:

- Comparing the best and worst performing super funds in each category (moderate, balanced, growth and aggressive growth)

- Giving you tips on how to pick the best super fund

- Telling you how much in fees you should be paying

Who topped our list (again)?

We've uncovered Australia's worst-performing super funds. For the tenth year in a row, OnePath has one of the largest number of Fat Cat Funds, this year ranking as the worst performer.

Our Fat Cat Funds Report will show you exactly which of their nine superannuation funds have been the worst-performing.

If your super is in one of these OnePath funds we urge you to compare your superannuation options today.

High superannuation fees harm you

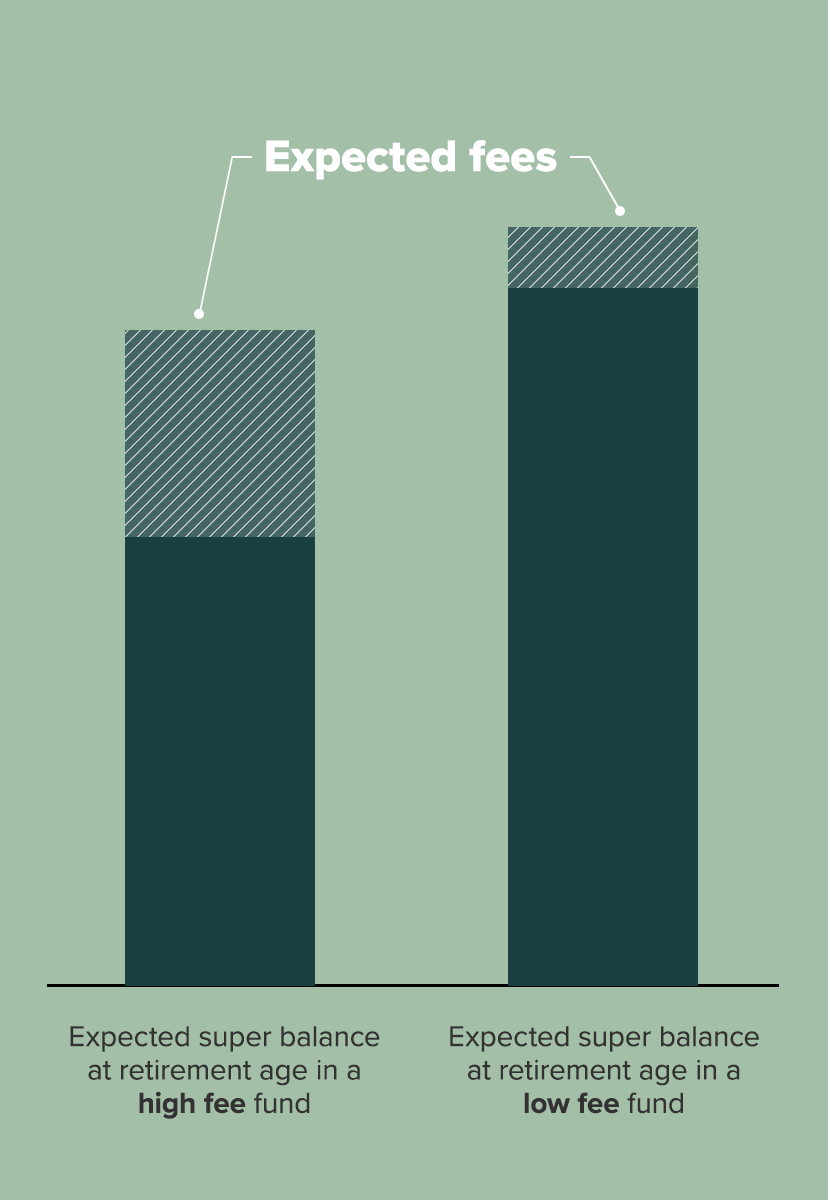

Our research has found that by choosing a superannuation fund that charges 1% less in fees than a similar fund will leave you $245,000 better off in retirement.

Fees are also an important consideration for those approaching retirement. As you reach retirement, your portfolio generally becomes more conservative. Fees take an even larger slice of your returns in a moderate or conservative super fund.

While you can't control the performance of your superannuation, you can control the superannuation fees that you pay.

Download the Fat Cat Funds Report and find out what impact high fees could have on your super balance.

The right superannuation investment options

Most people are unaware of how their superannuation funds are invested. However, this is crucial to understand, because how it's invested directly impacts how that money grows.

The Fat Cat Funds Report shows you why you should be wary of super funds that have large investments in unlisted property and infrastructure as part of their defensive mix, and why bigger funds are not necessarily the better funds.

Superannuation Info Hub

Previous Fat Cat Funds Reports

We've been comparing super funds since 2013. If you want to find out how your super fund has performed over the years, take a look at our previous Fat Cat Fund Reports.