Discover the best ETFs in Australia and all the latest trends

Thanks! The 2023 Stockspot ETF Report will be emailed to you in the next few minutes.

Australian ETFs: Key trends in the latest report

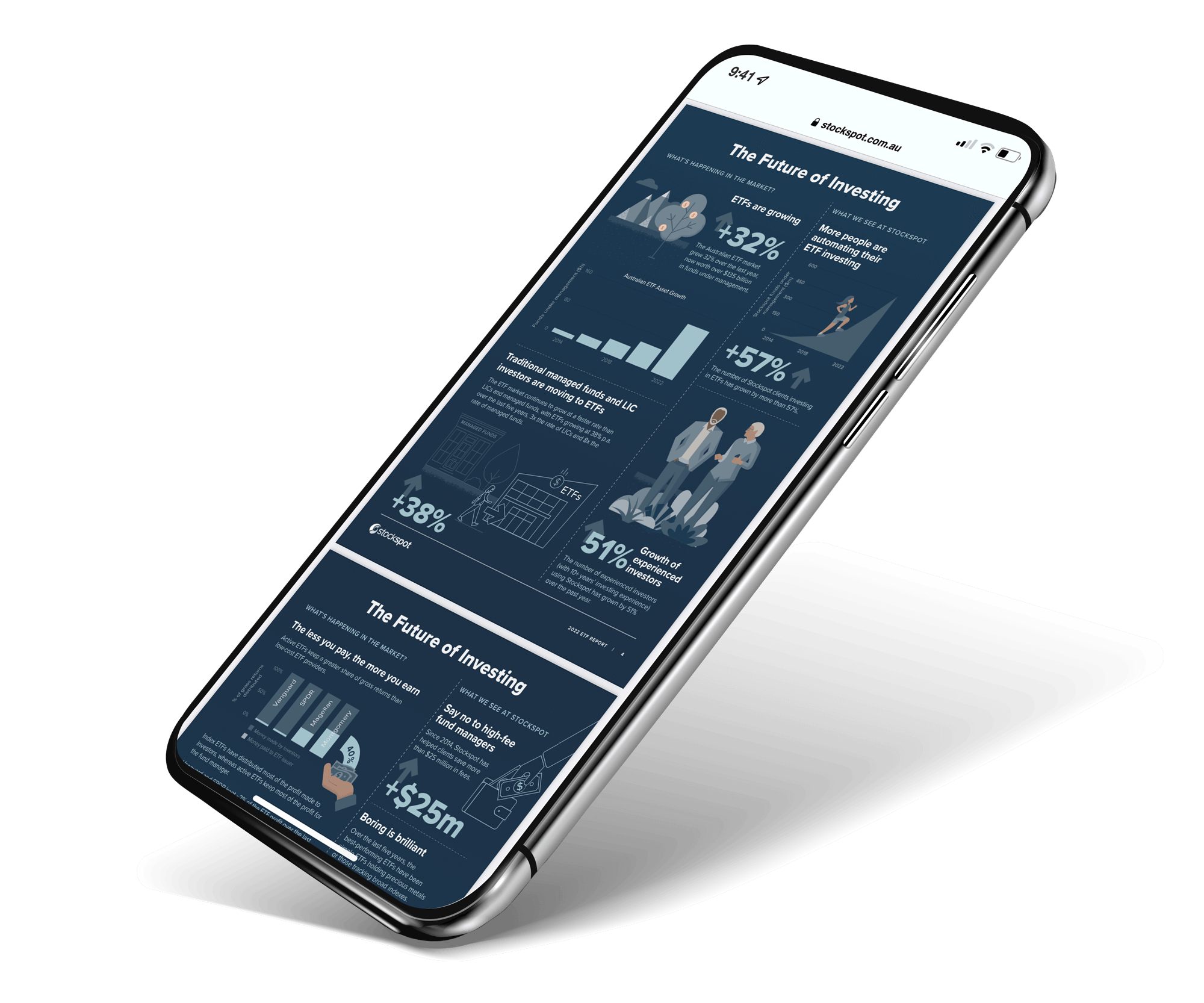

The 2023 Stockspot ETF Report reveals:

- The best and worst-performing ETFs

- Why 2023 was another strong year of growth for ETFs

- How much money Australians made in ETFs

- The ETFs with the most growth in assets under management

- Which ETFs are currently popular with investors

How to choose the best ETFs

Once you know the best short-term performing ETFs, you should invest as soon as possible…right?

Wrong.

Buying only the best-performing ETFs isn't a sound investment strategy. As this report shows, last year's winners often become this year's losers.

For investing success, you need diverse assets that counterbalance each other. A well-constructed portfolio of ETFs that consists of growth and defensive ETFs will help you ride the ups and downs of the market.

Stockspot is Australia's first and largest online investment adviser. Our speciality is ETFs.

We build you a custom investment portfolio of carefully selected ETFs. You get a range of different investments - with very low fees. And, unlike some other platforms, you directly own your ETFs. We don't receive commissions from any of the ETFs we recommend.

Invest in ETFs with Stockspot

ETF Info Hub

Previous ETF Research Reports

We've been researching ETFs in Australia since 2014. If you want to find out how ETFs have performed in previous years, take a look at our archived reports.

Find out more about ETFs in Australia

What are ETFs?

Still trying to figure out what ETFs are? We explain everything you need to know in this easy to understand guide.

Read the guideCompare ETFs

We compare over 200 ETFs listed on the ASX, including fees, performance, and funds under management.

Find out moreOur chosen ETFs

We've spent a lot of time selecting the right ETFs for our portfolios. See why we've picked these ones.

Stockspot ETFs