Easy investing with Stockspot: How it works

Are you ready to make your money work harder? It only takes minutes to get your personalised portfolio recommendation and set up your account. We'll guide you through each simple step.

Start investing

Add to your investments to grow your wealth faster.

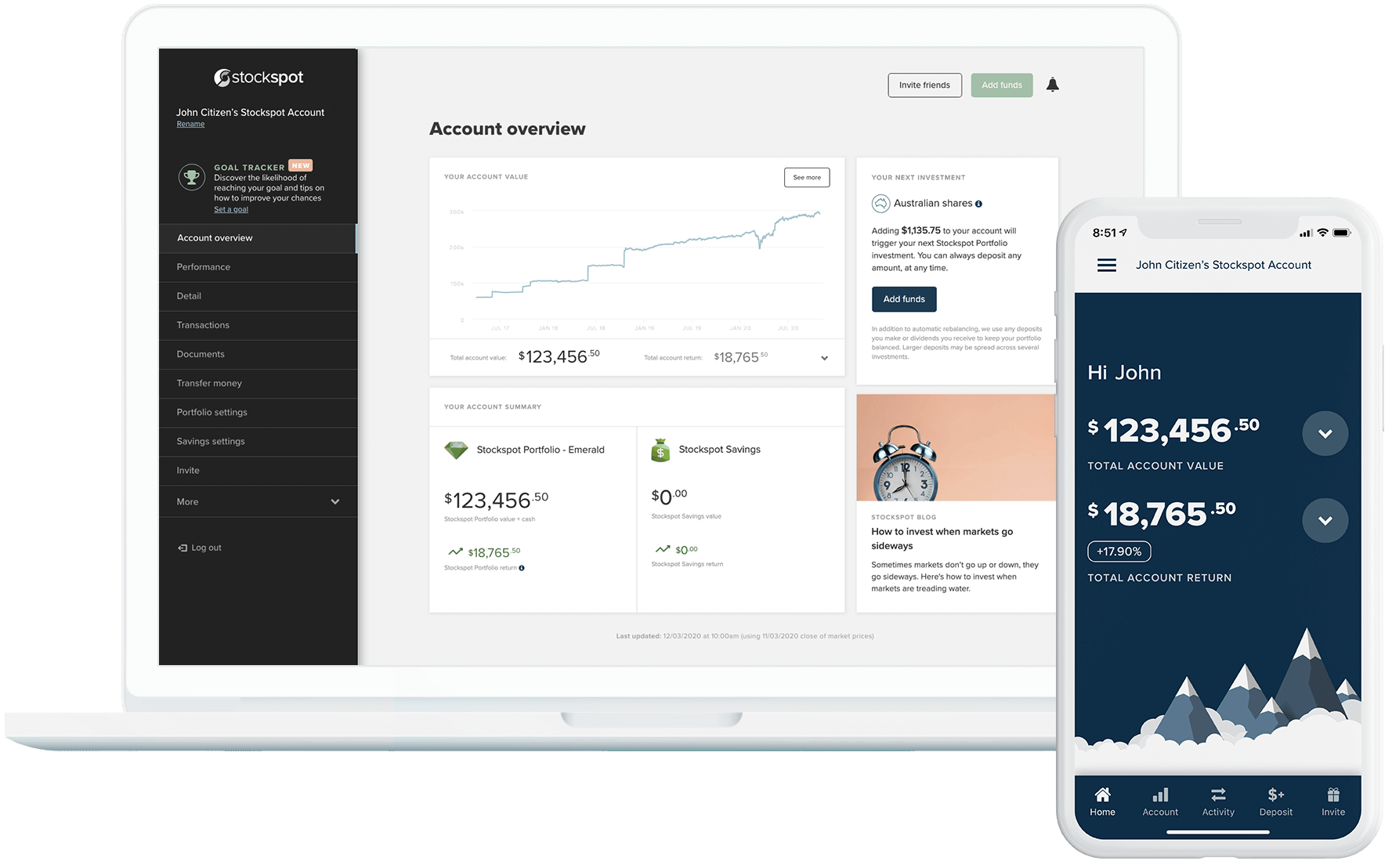

Monitor your portfolio to see the performance of your investments.

Keep track of your investment goals.

View your personal dashboard on any device.

Good advice can add around 3% per year in better performance. This extra return comes from:

Selecting the best low-cost products based on our extensive and regular research.

Maintaining a suitable investment mix for your situation and investing goals.

Helping you avoid costly investment mistakes with behavioural coaching.

The choice of automatic rebalancing so your portfolio remains healthy.

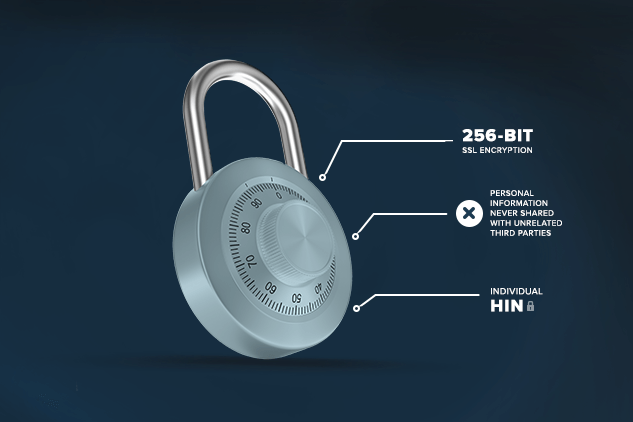

Our bank-level web security keeps your information safe and secure (for the geeks out there, that's our 256-bit SSL/TLS certificate).

Your investments are held safely in your own name under your own individual Holder Identification Number (HIN).

We never share your personal information with third parties.

Our minimum to start investing is just $2,000.

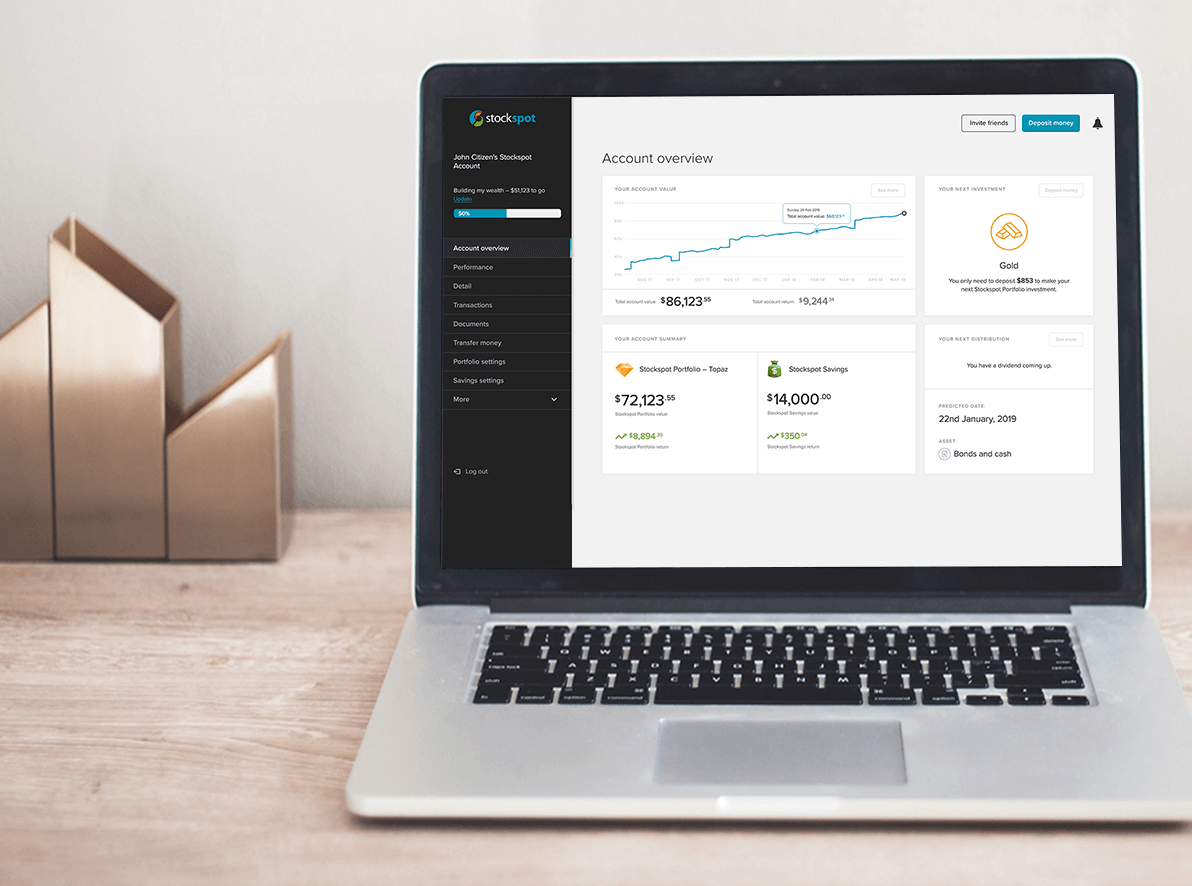

We ask a few questions so we can build an investment portfolio that suits your needs. Once your money arrives, we'll invest it automatically.

Yes, you can withdraw your money at any time with no penalty fees.

Refer to Pricing to view the Stockspot fee tiers.

Fees are charged monthly based on the average balance in your account over the month. Fees cover the ongoing management and rebalancing your portfolio, annual reviews to ensure that it continues to be the most suitable for your situation, administration and tax reporting.

We don't charge extra for brokerage and there are no other hidden costs. ETF fees are an indirect cost of approximately 0.25% p.a and come out of the ETF price.

We think you should be looking to invest for at least a few years. Any shorter and you're actually speculating, not investing. The longer you stay invested the better your chance of success.

You just need an email address and to set a password to get started.

If you decide to go ahead and invest with us, we require some standard ID details such as a passport or a driver licence to make sure we meet our 'Know Your Client' legal obligations.

We custom-built our questionnaire so that we can find out all the details we need to know about your situation.

From there our smart algorithms are able to recommend a portfolio that's best suited to your preferences and goals.

Stockspot portfolios have outperformed most similar funds over the years. You can find out about the Stockspot Portfolio returns here.

For account balances above $50,000, we offer Stockspot Themes, which allow you to add extra assets, countries or market sectors to your portfolio when you join.