What are ETFs

What are exchange traded funds (ETFs)?

ETFs (Exchange Traded Funds) are a type of investment that provide direct exposure to a wide range of companies and asset classes. ETFs cover investments such as Australian shares, international shares, bonds or metals. Most ETFs track a market index (ie. a section of the stock market), rather than taking bets on individual companies. ETFs are sometimes referred to as index funds.

The incredible thing about ETFs is that by buying one, an investor is able to utilise the same asset allocation tools and portfolio construction methodology that's used by the world's largest and most experienced financial institutions.

Watch our explainer video on ETFs.

The history of ETFs in Australia

The first ETFs to list in Australia were the SPDR S&P/ASX 50 Fund (SFY AU) and SPDR S&P/ASX 200 Fund (STW AU). They listed on the Australian Securities Exchange (ASX) on 27 August 2001.

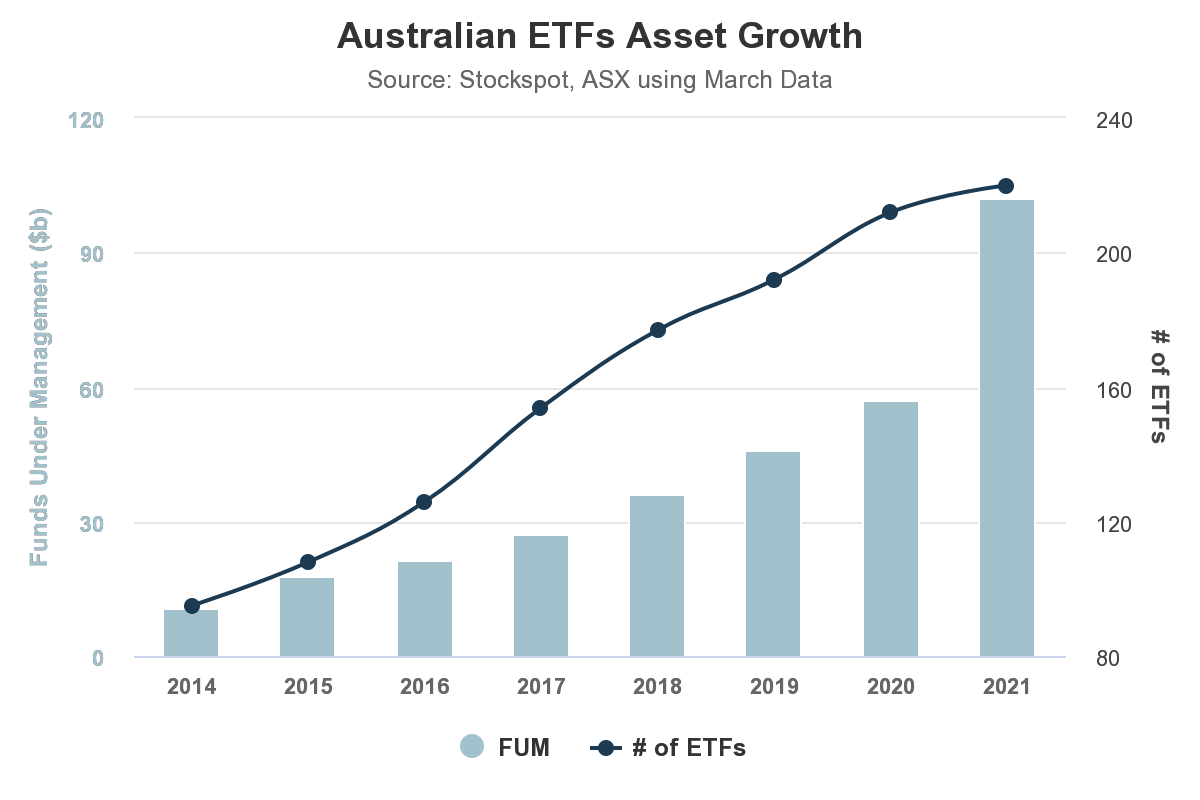

Over a 20 year period, the ETF industry has grown, and there is now approximately $100 billion held in ETFs in Australia.

Find out more about ETFs in Australia in our annual ETF report.

How do ETFs work?

ETFs generally track a market index (a subset of the stock market) rather than taking bets on individual companies. If shares are like a single flower, ETFs are like a bouquet. Essentially, you can invest in a broad range of companies all at once for a low fee. If you were to use a typical active fund manager to try and invest in all these different companies, the cost would be much higher.

You can buy ETFs in many different types of investments, from Australian shares to the top global companies, bonds, or property.

Difference between index funds and ETFs

The terms 'ETF' and 'index funds' are sometimes used interchangeably. But while ETFs have only been around since the early 1990s, index funds started in the 1970s.

Although both structures track an underlying index (ie. a portion of the stock market, like the ASX 200), you can't buy an index fund off the stock market, and they only have a price set at the end of the day. Both these factors limit the flexibility of index funds and make ETFs a more accessible option for many investors.

The other limiting factor of index funds is that they have a higher minimum investment requirement, whereas you can generally invest in ETFs with a much smaller amount. Index funds are also not as tax efficient as ETFs. That's because your money is pooled with other investors in an index structure which can cause unnecessary capital gains tax.

Who invests in ETFs?

Every year in Australia, experienced investors as well as novice investors buy into ETFs. Aside from individual investors, joint investors, companies, trusts, and Self Managed Super Funds (SMSFs) are also eagerly investing in ETFs.

It's not hard to see why. The benefits of using ETFs as a long-term passive investing vehicle are clear: they're low-cost, transparent, liquid (ie. you can generally sell them easily), and they also have tax advantages over traditional funds.

What are the benefits of ETFs?

Low cost

The management fees for index-based ETFs are usually significantly less than trying to get the same exposure to these companies through individually purchased shares. ETFs are also more cost efficient than actively managed funds.

Instant diversification

ETFs invest in all or a representative sample of shares in an index and provide a highly diversified investment. A diversified investment is one that spreads your risk, so you're less likely to experience a big loss.

Access to different investments

With ETFs, an individual investment is pooled with other investors' money. This offers investors access to a wider range of investments, which may not be otherwise accessible to an individual investor.

Potential tax efficiency

One of the reasons exchange-traded funds (ETFs) have gained popularity with Australian investors is because they are highly tax efficient. Compared to other investments like managed funds and Listed Investment Companies (LICs), ETFs tend to have lower turnover and pay out fewer capital gains.

Transparency

ETF issuers (the organisations that create ETFs) provide daily information to investors around underlying holdings of the ETF and the Net Asset Value (NAV). This means you know exactly what you are investing in and what the ETF should trade for on the sharemarket.

Liquidity

Unlike unlisted managed funds, you can buy and sell ETFs during ASX trading hours. The things that determine whether an ETF is easy to sell are the market participants and how often the underlying holdings of the ETFs are traded daily.

What are the Risks of ETFs?

All investments have some element of risk, and ETFs are no different.

Market risk

ETFs invest in a broad range of assets all at once, which protects you against the specific risk of an individual security or stock performing poorly. Nonetheless, investors are still exposed to market risk. For example, if the broad Australian stock market falls, an ETF that tracks the S&P/ASX 200 index will equally fall in value.

Currency risk

Investors are exposed to currency risk if they hold an international unhedged ETF.

Liquidity risk

This is the risk you may not be able to sell your ETFs for a fair price. Liquidity can vary between different ETFs. Some are actively traded. Others have relatively low turnover, which can make buying and selling at a fair price more difficult.

Other important ETF concepts

We cover everything that's happening in the ETF landscape in our annual ETF report, and you can search for ETF articles on our blog.

Here we explain two important concepts.

How does currency affect ETF returns?

ETFs provide Australian investors with an ability to access investments that aren't usually traded in Australian dollars ($AUD). This means that ETF issuers can choose whether or not to remove or 'hedge' currency risk. (Currency risk is the possibility of losing money due to movements in the exchange rate). Hedging means that the ETF issuer has converted the underlying assets from their home currency to $AUD.

There is no right or wrong answer to whether ETFs should be hedged or not. Some ASX listed ETFs are unhedged while some ETFs hedge currency exposure. Find out more about hedged versus unhedged ETFs.

What are Authorised Participants and market makers?

Authorised Participants or APs have an agreement in place with the ASX and ETF issuer to create and redeem units in an ETF. An AP can effectively swap ETF units for corresponding baskets of underlying securities and vice versa. The required basket of securities is published every day by the issuer and reflects the investments and value of the underlying ETF.

APs are important because their creation and redemption process ensures that ETFs closely track their index. This is different to Listed Investment Companies (LICs) which can trade at substantial discounts to their Net Tangible Assets (NTA).

A Market Maker's role is slightly different. They provide liquidity to the market by quoting buy and sell prices throughout the trading day. Market makers place a buy/sell spread around the true value of the ETF and send these prices to the stock exchange as orders. Market maker orders are updated continuously throughout the day to reflect price changes in the underlying securities.

How to invest in ETFs

Now you're well versed in the world of ETFs, you might be wondering how to invest in them.

You can open your own brokerage account, research all the different ETFs and then decide which one is best for you. Since dozens of new ETFs are being launched each year, this could take a fair bit of time.

The other option is to use a service like Stockspot. We create a custom portfolio of ETFs for you that we rebalance according to market movements.You don't need to do anything except let your investments work for you over the long-term.

If you want us to get you started on your ETF journey, then get a free ETF portfolio recommendation today. You can start investing whenever suits you.

See which custom ETF portfolio we recommend for you.

Get started

Other ETF Resources

Stockspot ETF Report

Every year we analyse the ETF landscape. Find out the latest trends, the best performing ETFs, the worse performing ones - and much more.

Read the guide »

Compare ETFs

We compare over 200 ETFs listed on the ASX, including fees, performance, and funds under management.

Find out more »

Our chosen ETFs

We've spent a lot of time selecting the right ETFs for our portfolios. See why we've picked these ones.

Stockspot ETFs »