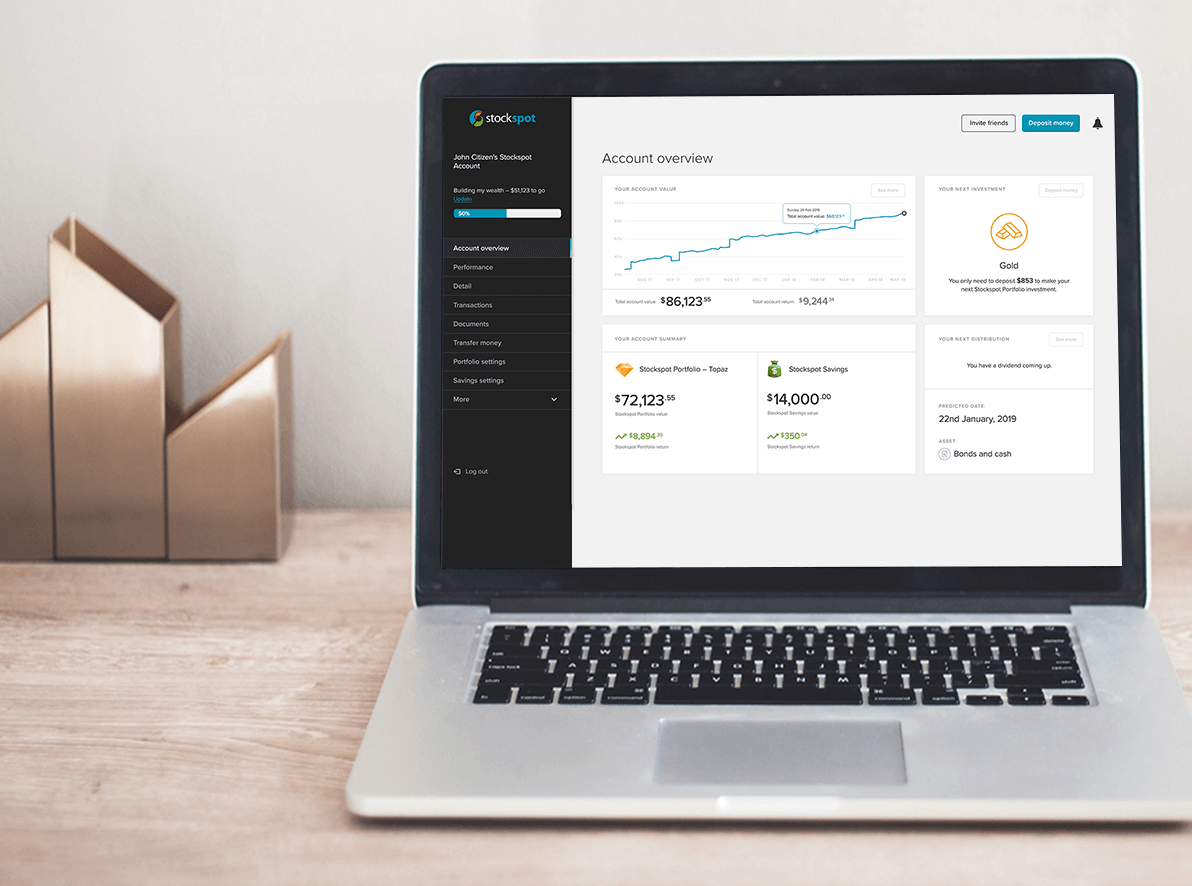

Joint investing made easy

Whether you're saving up for a home, growing your wealth as a couple, investing as a family or with your business partner, Stockspot's joint accounts can help you get where you want to be.

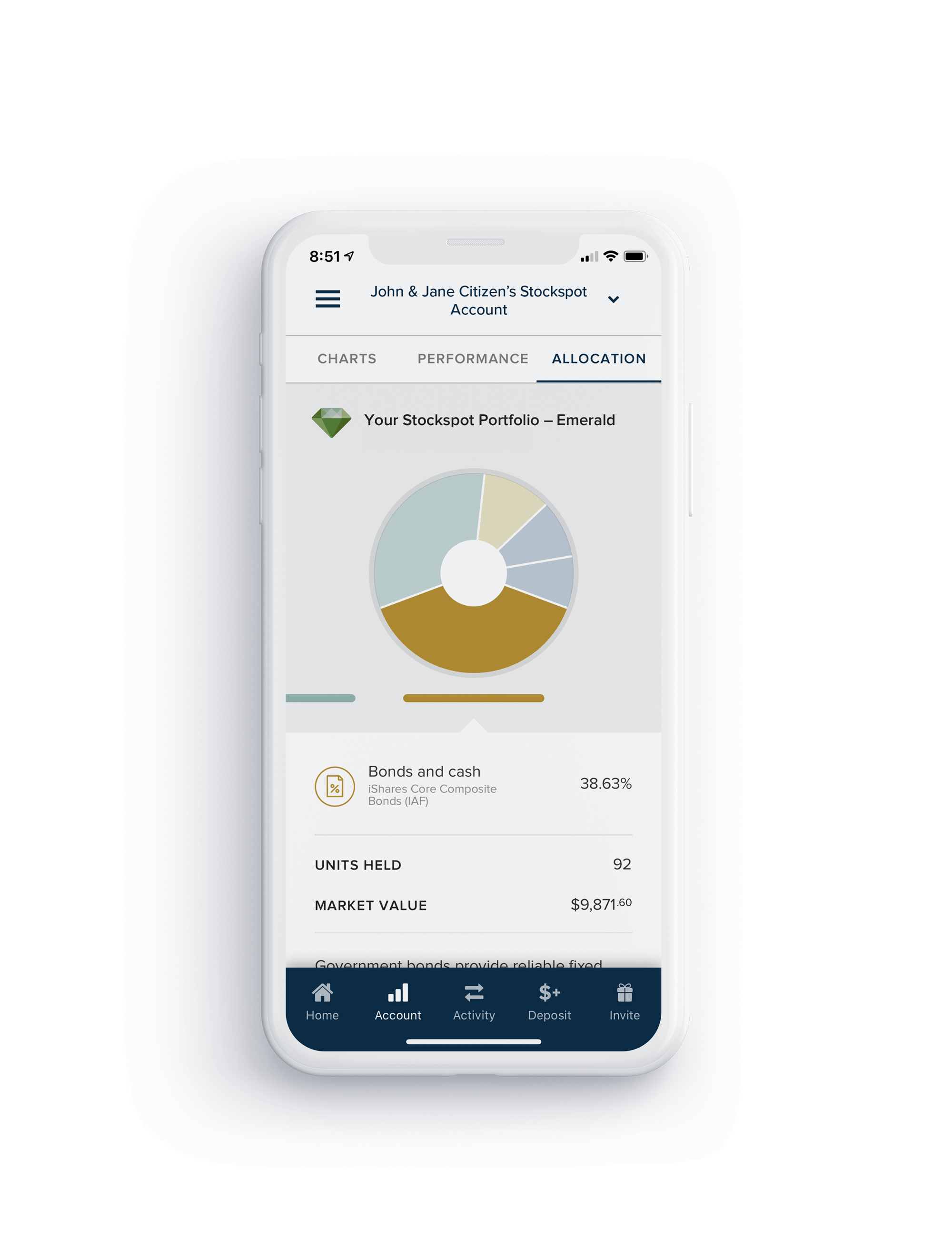

Stockspot builds you a smart, custom portfolio of low-cost ETFs (exchange traded funds) by combining the expertise of qualified investment advisers and an automated investment platform.